The AGAD Framework

A behavioral classification system for portfolio construction. Four pillars that reveal how positions actually perform across market regimes—the missing layer between asset class labels and total portfolio view.

Four Quadrants, One Portfolio

AGAD organizes investments by their economic behavior across different market conditions, not by their legal structure or asset class label.

Four behavioral quadrants forming a coherent portfolio structure

Composite behavior across market regimes

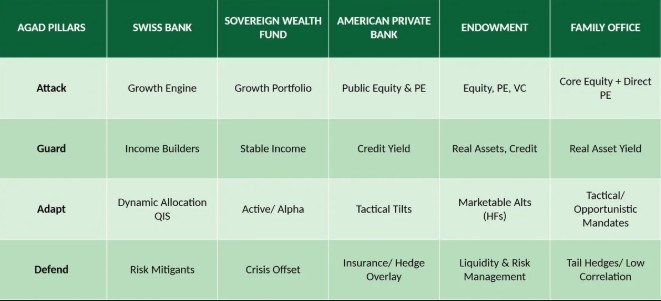

Behavioral Classification Across Institutional Contexts

Each pillar manifests differently across institutional mandates—but the behavioral characteristics remain consistent.

The Problem with Traditional Portfolio Construction

Asset class labels and factor models fail to provide actionable insight during market stress. Three fundamental issues persist:

Can't Visualize Regime Behavior

Asset class labels don't reveal how positions behave during growth vs. crisis vs. transition periods.

Hidden Concentration Risk

Traditional allocations mask correlation breakdowns that emerge during stress—exactly when diversification matters most.

No Actionable Framework

Statistical factor models are academically rigorous but operationally useless during market dislocations.

Four Behavioral Pillars

AGAD classifies positions by economic behavior, not legal structure. Each pillar serves a distinct role across market regimes.

Analyze Your Portfolio

Use our free tool to see how your current holdings map to Attack, Guard, Adapt, and Defend. No signup required.

Portfolio Analysis ToolSubscribe to Research

In-depth articles on portfolio construction, regime analysis, and behavioral risk classification.

Branches and Vines